The team at Merritt works in QuickBooks, which is helpful for easy handoff to your accountant and in case you decide down the line to bring your bookkeeping in-house. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. Similarly, an accurate representation of your current bookkeeping will allow you to forecast realistic financial goals for your business to hit over the next quarter or year. Designed for small businesses, Kashoo features an all-inclusive pricing structure, and you can add additional users to Kashoo at no additional cost. Double-entry accounting uses a debit and a credit when making an entry.

Your financial transactions

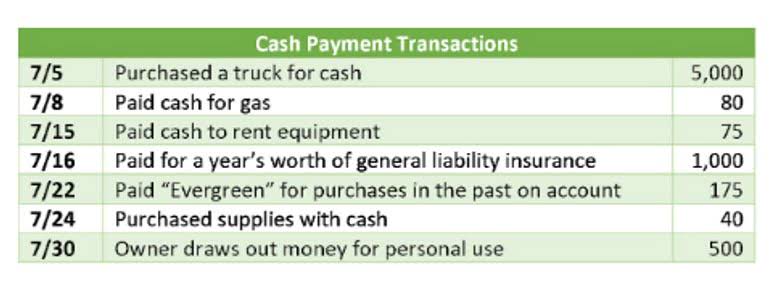

The way you categorize transactions will depend on your business and industry. Generally speaking, your transactions fall into five account types—assets, liabilities, equity, revenue, and expenses. Individual line items are then broken down into subcategories called accounts. In our ice cream shop example, some accounts in your ledger might be “revenue-ice cream sales”, “expenses-ice cream ingredients”, etc.

- Most of the best accounting software programs will help you track your business income and business expenses automatically without you having to create spreadsheets and do manual data entry.

- Under double-entry bookkeeping, all transactions are entered into a journal, and then each item is entered into the general ledger twice, as both a debit and a credit.

- Lenders and investors want a clear idea of your business’ financial state before giving you money.

- To rank the best states to start a business in 2024, Forbes Advisor analyzed 18 key metrics across five categories to determine which states are the best and worst to start a business in.

- If you intend to do payroll in-house, you’ll want a software program matching your business type.

- Accounting software is a tool that allows you to track and manage the day-to-day finances of your businesses.

How to do bookkeeping for small businesses

Without basic bookkeeping practices, it’s easy for financial transactions and spending activities to get out of control, which can lead to confusion, disorganization, and loss of profit. Consider whether small business bookkeeping you want to keep your personal and business bank accounts at the same financial institution. On the other hand, your bank may provide perks for keeping your personal and business accounts with them.

When is it time to hire someone?

Simply turn your financial statements over to your CPA or other tax filings expert, and let them handle the rest. Fortunately, small business owners don’t need to be experts in mathematics to find success when doing their own bookkeeping. There are many ways to divide bookkeeping responsibilities and leverage powerful technology and small business accounting software for more accurate expense tracking. There are many bookkeeping services available that can do all of this for you, and more.

Small businesses added more jobs in May, but wage growth slowed

At the end of every pay period, the bookkeeper will accumulate employee payroll details that include hours worked and rates. From there, the total pay is determined with the applicable taxes and withholdings. In the accounting software, the primary journal entry for total payroll is a debit to the compensation account and credits cash. Generally speaking, bookkeepers help collect and organize data and may have certain certifications to do so for your business. On the other hand, accountants are generally equipped with an accounting degree and may even be state-certified CPAs.

Understanding taxes and deductions

Deirdre Fields takes the stress out of bookkeeping for small businesses – Vicksburg Daily News

Deirdre Fields takes the stress out of bookkeeping for small businesses.

Posted: Sun, 12 Nov 2023 08:00:00 GMT [source]

Enter your loan information to get an estimated breakdown of how much you’ll pay over the lifetime of your loan. If Bench does your bookkeeping, you can also upload and store as many digital receipts and documents as you’d like in the Bench app. Kelly Main is a Marketing Editor and Writer specializing in digital marketing, online advertising and web design and development. Before joining the team, she was a Content Producer at Fit Small Business where she served as an editor and strategist covering small business marketing content. She is a former Google Tech Entrepreneur and she holds an MSc in International Marketing from Edinburgh Napier University.

Our partners cannot pay us to guarantee favorable reviews of their products or services. We believe everyone should be able to make financial decisions with confidence. Never leave the practice of bookkeeping (or your business assets) to chance. No matter what system you implement, incorporate a practice of reconciliations, by comparing the numbers in your system to the source records, like bank statements, receipts, and invoices. This habit improves communication, boosts transparency with your bookkeeping team, and promotes longevity and compliance.

- Remember that each transaction is assigned to a specific account that is later posted to the general ledger.

- You’ve had to focus more closely than ever on money coming in and going out.

- Accounting means not just keeping financial records but also analyzing and interpreting financial data so you can make wise fiscal decisions.

- Similarly, an accurate representation of your current bookkeeping will allow you to forecast realistic financial goals for your business to hit over the next quarter or year.

Miscalculations can result in large penalties if miscalculations are sent to the IRS or state tax department. If your business requires the collection of sales tax, you may be required to submit accurate quarterly payments, depending on your state’s requirements. When setting up a bookkeeping or accounting system for your small business, you first need to decide between manual record keeping, using business accounting software, or hiring an outside firm. Learn how bookkeeping can streamline business practices with https://www.bookstime.com/compare-bookkeeping-solutions tips.